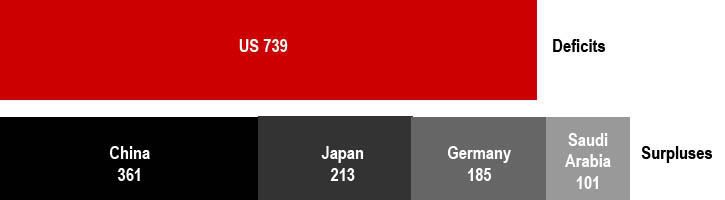

Global Balance of Payments ($bn, 2007)

SOURCE: Martin Wolf, "Asia's Revenge," Financial Times, 9 October 2008, p. 9.

What lay behind the savings glut? The first development was the shift of emerging economies into a large surplus of savings over investment. Within the emerging economies, the big shifts were in Asia and in the oil exporting countries (see chart). By 2007, according to the International Monetary Fund, the aggregate savings surpluses of these two groups of countries had reached around 2 per cent of world output.There is no political or economic incentive on the part of the biggest deficit spenders, especially the US, to change this pattern. The change therefore has to come from surplus generators.

. . . . . . . . . . . . . . . . . . . .

Last year, the aggregate surpluses of the world's surplus countries reached $1,680bn, according to the IMF. The top 10 (China, Japan, Germany, Saudi Arabia, Russia, Switzerland, Norway, Kuwait, the Netherlands and the United Arab Emirates) generated more than 70 per cent of this total. The surpluses of the top 10 countries represented at least 8 per cent of their aggregate GDP and about one-quarter of their aggregate gross savings.

Meanwhile, the huge US deficit absorbed 44 per cent of this total. The US, UK, Spain and Australia -- four countries with housing bubbles -- absorbed 63 per cent of the world's current account surpluses.

That represented a vast shift of capital – but unlike in the 1970s and early 1980s, it went to some of the world's richest countries. (emphasis added, Wolf, p. 9)

No comments:

Post a Comment