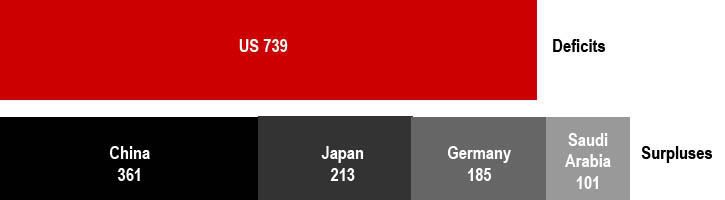

It's true that, if China, Japan, Germany, Saudi Arabia, and the United States functioned as one politically (if not legally) coherent establishment, Americans would be back in the black:

Global Balance of Payments ($bn, 2007)

SOURCE: Martin Wolf, "Asia's Revenge," Financial Times, 9 October 2008, p. 9.

Therefore, a radical shift in global class relations could come only if there were a radical shift in any one of the aforementioned countries, but these are the very ones where the Left has the least chance in the world.

Is China, though, a weak or strong link in this chain of empire (to which Latin socialists, Islamists from the Hindu Kush to the Persian Gulf to the Horn of Africa to the Niger Delta, Maoists in Nepal and India, the national security interests of Russia, etc. have provided a partial material -- if ideologically incoherent -- counterweight)?

Update

"[T]he needs of our economy require that our financial institutions not take this new capital to hoard it, but to deploy it" ("Text: Henry Paulson Remarks Tuesday," 15 October 2008).

"Investors are recognizing that the financial crisis is not the fundamental problem. It has merely amplified economic ailments that are now intensifying: vanishing paychecks, falling home prices and diminished spending. And there is no relief in sight" (Peter S. Goodman, "Markets Suffer as Investors Weigh Relentless Trouble," New York Times, 16 October 2008).

No comments:

Post a Comment